Introduction

Digital wallets (or e-wallets) are one of the most popular innovations in the personal finance space. By storing debit, credit, and even cryptocurrency in a digital format, these wallets allow users to make fast, secure transactions without the need for physical cards or cash. As consumers continue to demand convenience and security, digital wallets are becoming essential tools for managing finances. At The Tech Whale, we are empowering businesses to integrate digital wallet solutions that meet the evolving needs of users.

What Is a Digital Wallet?

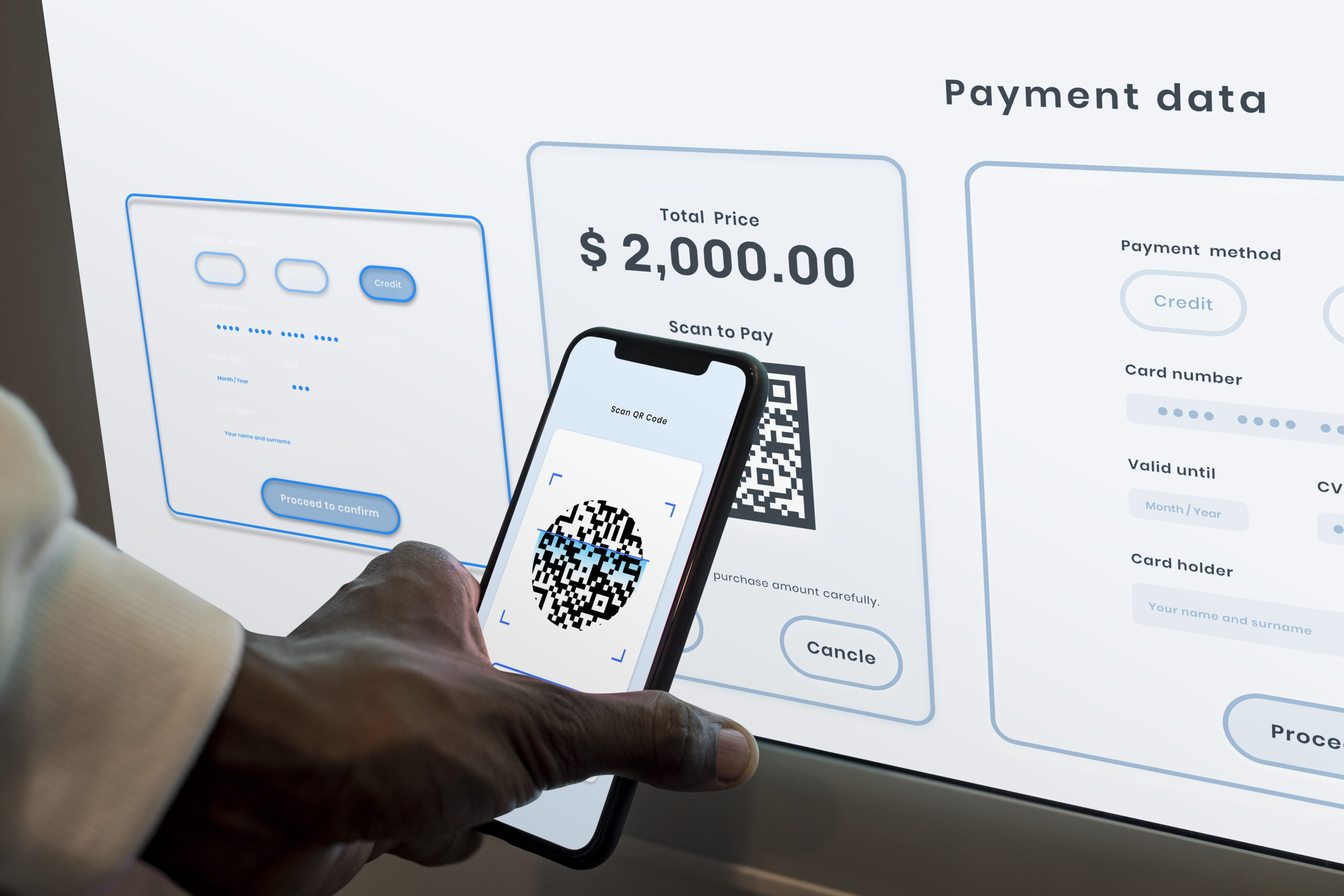

A digital wallet is an electronic version of a physical wallet, allowing users to store their financial information securely on their smartphones or other devices. It can store payment information (credit and debit cards), identification, tickets, loyalty cards, and even digital currencies. Popular digital wallets like Apple Pay, Google Pay, and Samsung Pay make it easier for users to pay for goods and services using their mobile phones.

The Security of Digital Wallets

One of the most significant benefits of digital wallets is security. With features like biometric authentication, tokenization, and encryption, digital wallets provide a secure way to make payments without exposing sensitive information. For example, when you use Apple Pay or Google Pay, your card information is replaced with a unique token, ensuring that your actual credit card details are never shared during transactions.

Digital Wallets and Cryptocurrency: A New Frontier

In addition to traditional payment methods, many digital wallets now support cryptocurrency storage and transactions. Apps like Coinbase Wallet and Trust Wallet enable users to store Bitcoin, Ethereum, and other cryptocurrencies securely. As digital currencies become more mainstream, digital wallets are playing an increasingly important role in integrating crypto into everyday personal finance.

Convenience and Speed in Payments

Digital wallets allow users to make instant payments without having to carry cash or credit cards. With just a few taps, users can pay bills, transfer money, and make online purchases, all while reducing the friction that comes with traditional payment methods. This convenience is one of the main reasons why digital wallets are becoming a preferred option for consumers worldwide.

Integration with Other Financial Services

Digital wallets are becoming even more powerful as they integrate with a variety of financial services. For example, some wallets allow users to set up automatic bill payments, track expenses, and even invest directly through the wallet’s interface. By offering integrated solutions, digital wallets are positioning themselves as central hubs for managing all aspects of personal finance.

Conclusion Digital wallets are rapidly becoming a cornerstone of personal finance. With their convenience, security, and growing integration with other financial tools, they are revolutionizing the way users make payments, store funds, and manage their finances. “The Tech Whale” helps businesses implement digital wallet solutions, ensuring they meet the needs of a tech-savvy, mobile-first consumer base.