The Role of Digital Wallets in the Future of Personal Finance

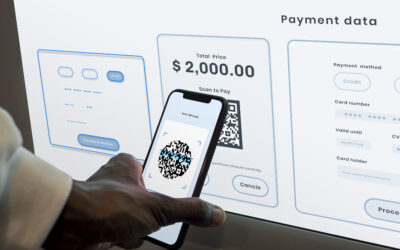

Introduction Digital wallets (or e-wallets) are one of the most popular innovations in the personal finance space. By storing debit, credit, and even cryptocurrency in a digital format, these wallets allow users to make fast, secure transactions without the need for physical cards or cash. As consumers continue to demand convenience and security, digital wallets…