The global digital payments industry is entering a new phase of speed, security, and inclusivity. Powered by AI fraud detection, biometric authentication, and expanding real-time payment networks, consumers and businesses alike are embracing a world where cash is increasingly obsolete.

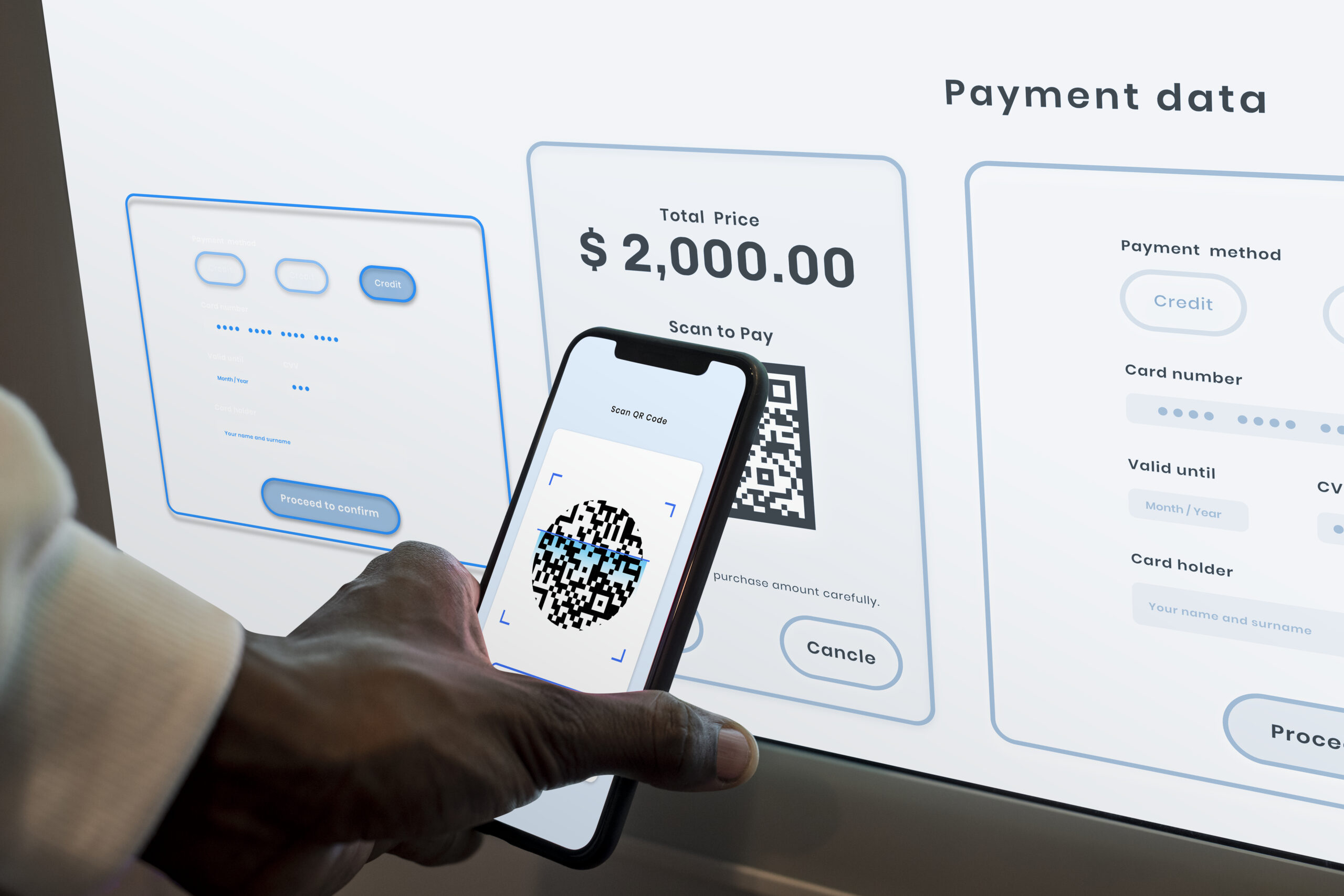

Contactless and Mobile Wallets Lead Everyday Transactions

Tap-to-pay and QR-code systems now account for more than 80% of point-of-sale transactions in major economies. Mobile wallets such as Apple Pay, Google Pay, PhonePe, and AliPay have evolved into all-in-one financial hubs, offering savings accounts, credit lines, and loyalty programs in a single app.

Real-Time and Cross-Border Payments Surge

Governments and central banks are rapidly linking instant payment rails like India’s UPI, the U.S. FedNow, and Europe’s TIPS, creating near-instant international transfers. Banks and fintechs are also piloting ISO 20022-based systems that allow payments to settle within seconds, even across continents.

AI and Biometrics Strengthen Security

With fraud attempts rising, payment providers are deploying machine-learning algorithms to flag suspicious activity in milliseconds. Meanwhile, biometric verification—fingerprint, facial, and even palm-vein scanning—is becoming standard, reducing reliance on passwords and PINs.

Stablecoins and CBDCs Enter Mainstream Commerce

Stablecoins such as USDC and central-bank digital currencies (CBDCs) are being integrated into retail and B2B platforms. Major retailers and e-commerce sites now accept blockchain-based payments alongside traditional methods, bringing programmable money into everyday life.

Embedded Finance Creates Invisible Payments

Ride-hailing, travel, and subscription services increasingly use embedded payments, where charges happen seamlessly in the background. Consumers expect frictionless checkout experiences—whether paying for groceries, streaming services, or electric-vehicle charging.

Regulatory Focus on Privacy and Interoperability

Global regulators are issuing new rules on data privacy, cross-border standards, and open banking APIs to ensure digital payments remain both competitive and secure. The EU’s PSD3 directive and similar frameworks in Asia and the Americas emphasize interoperability and consumer protection.